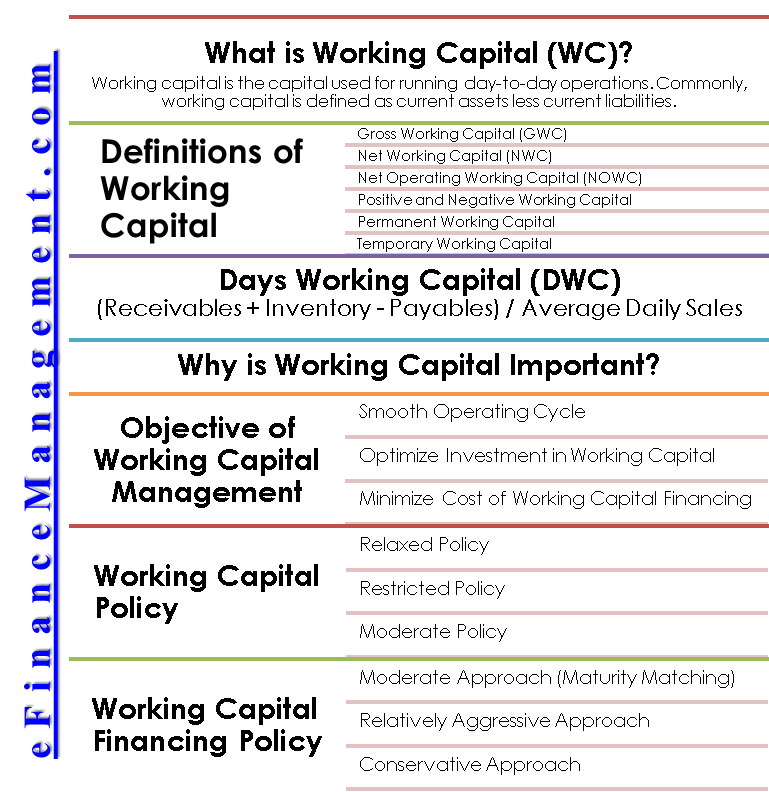

working capital funding gap

What actions could a company take to reduce its working capital funding gap. One of the best advantages is that working capital financing is that you can receive.

Working Capital Financing What It Is And How To Get It

The proportion of the.

. Whats the forecasted capital. The keys to managing the cash flow gap are as follows. Days working capital is an accounting and finance term used to describe how many days it takes for a company to convert its working capital into revenue.

Work to match up the days outstanding for trade payables with the days outstanding for accounts receivable. Managing the working capital fund gap. In the first part you learn how to get out of a short-term financing gap by increasing working capitalIn the second part you learn how to increase.

What actions could a company take to reduce its working capital funding gap. What actions could a company take to reduce its working capital funding gap. This is particularly prominent in supply chain funding.

The debt to equity ratio indicates. Building effective working relationships between corporates and banks. Negotiate the contract with suppliers to be able to delay the payments.

Working capital funding gap refers to a gap that exists when the amount of money that is needed to fund ongoing operations or the future. What actions could a company take to reduce its working capital funding gap. Give customers a discount if they pay.

It can be used in ratio. Why the Working Capital Funding Gap Exists. Tighten customer credit terms.

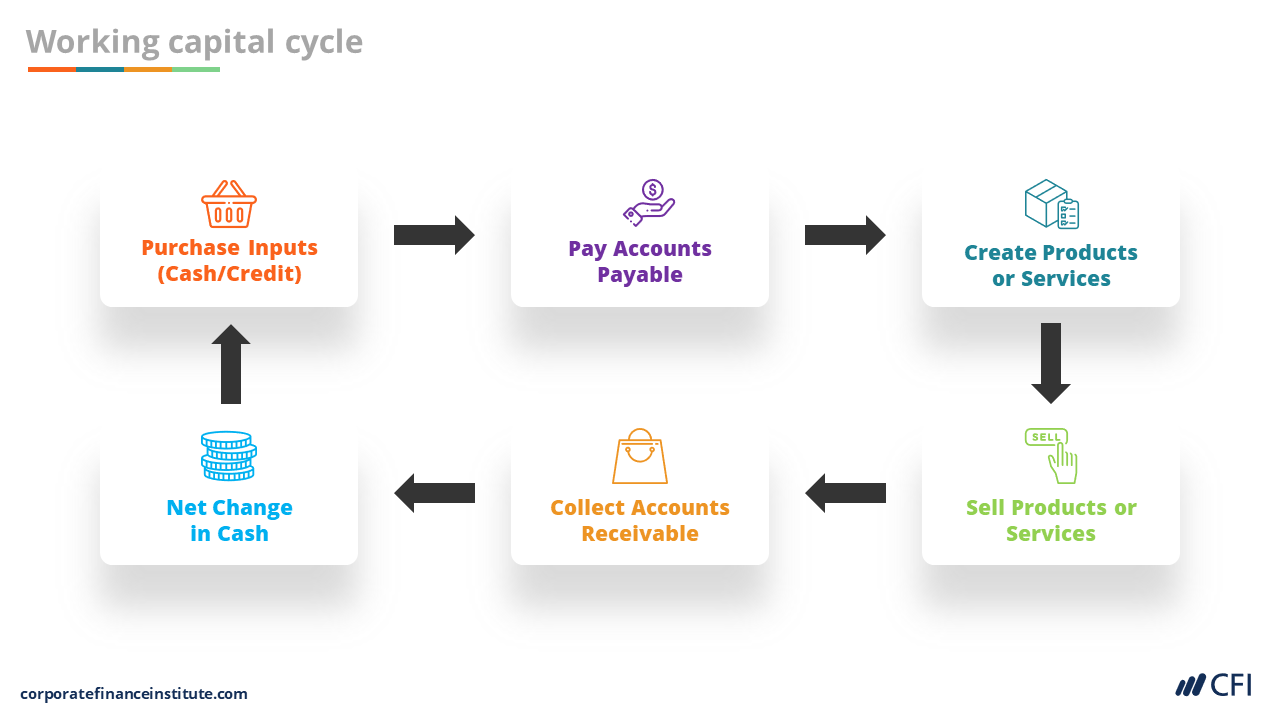

The Working Capital Cycle for a business is the length of time it takes to convert net working capital current assets less current liabilities all into cas. Automation simplifies this a lot. This is a two part series.

To get idle funds 1. The action Company should take to reduce its working capital funding gap by Increasing inventory levels. Stockpile the inventory and make sure they are not out-of-stock.

When a business experiences a short-term gap in working capital they need cash now. Working capital can be negative if current liabilities are greater than current assets. 1b Allow customers to delay payments.

Working capital is the cash used daily cover all of a corporations. Prior to 2008 many small businesses applied for a loan from their bank and a good portion of them were successful. Raise the price of the products to increase.

Gaining a few days. Working capital is the difference between a companys current assets and current liabilities. Send invoices early so that you can get inflows faster.

What actions could a company take to reduce its working capital funding gap.

New Report Highlights Needed Solutions To Address Gaps In Access To Capital That Hold Back Entrepreneurs Of Color

Closing The Funding Gap The Case For Esg Incorporation And Sustainability Outcomes In Emerging Markets Discussion Paper Pri

Rfs Secrets To Working Unsecured Capital Real Estate Funding Youtube

Cash Flow Cycles And Analysis I Finance Course I Cfi

Working Capital Cycle What Is It With Calculation

Black Business Owners Shut Out From Capital Nerdwallet

Working Capital Funding Gap Problem Water Cooler Analystforum

Working Capital Funding Gap Ppt Powerpoint Presentation Portfolio Tips Cpb Presentation Graphics Presentation Powerpoint Example Slide Templates

Investment In Small Businesses Can Build Resilient Emerging Economies World Economic Forum

Working Capital Cycle Definition How To Calculate

Business Growth And The Inevitable Funding Gap

Working Capital What Is Working Capital Youtube

Vernimmen Corporate Finance Working Capital Requirement And Financial Debt Where To Draw The Line

Working Capital Importance Policy Manage Finance Efm

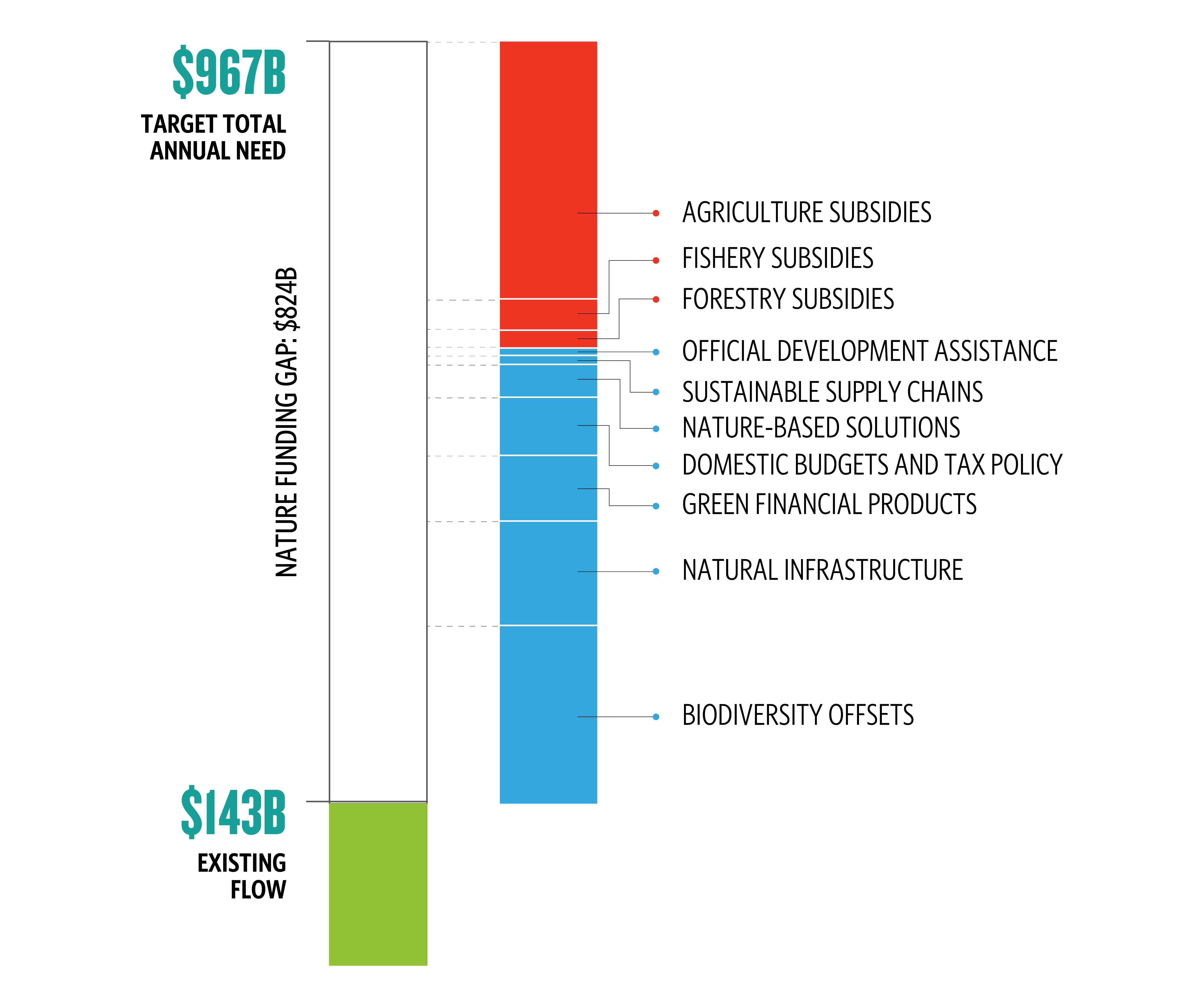

Closing The Nature Funding Gap The Nature Conservancy

Solved Calculate Accounts Receivable Days Based On The Chegg Com

Working Capital Cycle Understanding The Working Capital Cycle

Working Capital Formula Calculator Excel Template

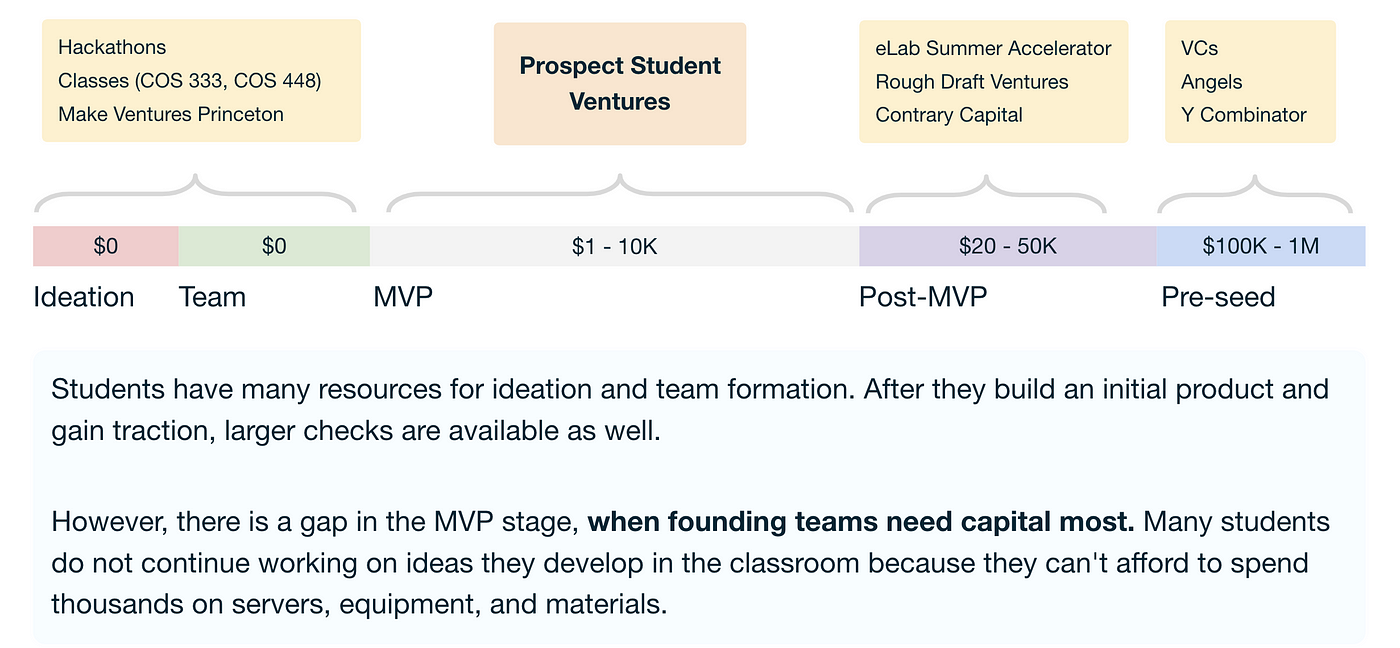

Introducing Prospect Student Ventures By Ayushi Sinha Prospect Student Ventures Medium